- Industrial zone, South of Anping Town, Hengshui, Hebei, China.

- sales@hfpetromesh.com

- +86-18931809706

2 月 . 20, 2025 08:19

Back to list

perimeter safety net

Navigating the realm of financial security, the term safety net encapsulates a multitude of products designed to cushion life's unpredictable twists. As society evolves, so does the necessity for innovative financial safety nets. Whether you're familiarizing yourself with existing options or considering their expansion, understanding the landscape of these products is essential.

Trustworthiness is a critical metric in appraising safety net products, particularly in the context of private financial services. Consumers seek assurance that their investments and insurance plans are secure. Consequently, institutions providing these services must be transparent about their credibility, backed by ratings from financial watchdogs and customer reviews. Banking institutions, investment firms, and insurance providers that consistently receive high trust ratings are often preferred. Emerging products in the digital space offer new rhythm to the drumbeat of financial security. Fintech innovations, such as automated savings tools and micro-investment platforms, elevate financial literacy and accessibility, ensuring even those with modest incomes can participate in wealth-building activities. These products are particularly potent in enhancing trust by leveraging encryption and secure transactions, thus providing confidence in digital engagements. In summary, the sphere of safety net products is vast, encompassing traditional and modern solutions that address diverse financial needs. Whether through personal reflections on the comfort of emergency funds, expert insights on insurance plans, authoritative evaluations of government programs, or trustworthy innovations in fintech, the narrative around financial safety nets is both rich and crucial. By continually adapting to societal shifts, these products not only promise stability but also empower individuals to face uncertainties with confidence. As markets and technologies advance, exploring these products with a discerning eye remains essential for anyone seeking comprehensive financial well-being.

Trustworthiness is a critical metric in appraising safety net products, particularly in the context of private financial services. Consumers seek assurance that their investments and insurance plans are secure. Consequently, institutions providing these services must be transparent about their credibility, backed by ratings from financial watchdogs and customer reviews. Banking institutions, investment firms, and insurance providers that consistently receive high trust ratings are often preferred. Emerging products in the digital space offer new rhythm to the drumbeat of financial security. Fintech innovations, such as automated savings tools and micro-investment platforms, elevate financial literacy and accessibility, ensuring even those with modest incomes can participate in wealth-building activities. These products are particularly potent in enhancing trust by leveraging encryption and secure transactions, thus providing confidence in digital engagements. In summary, the sphere of safety net products is vast, encompassing traditional and modern solutions that address diverse financial needs. Whether through personal reflections on the comfort of emergency funds, expert insights on insurance plans, authoritative evaluations of government programs, or trustworthy innovations in fintech, the narrative around financial safety nets is both rich and crucial. By continually adapting to societal shifts, these products not only promise stability but also empower individuals to face uncertainties with confidence. As markets and technologies advance, exploring these products with a discerning eye remains essential for anyone seeking comprehensive financial well-being.

Share

Prev:

Next:

Latest news

-

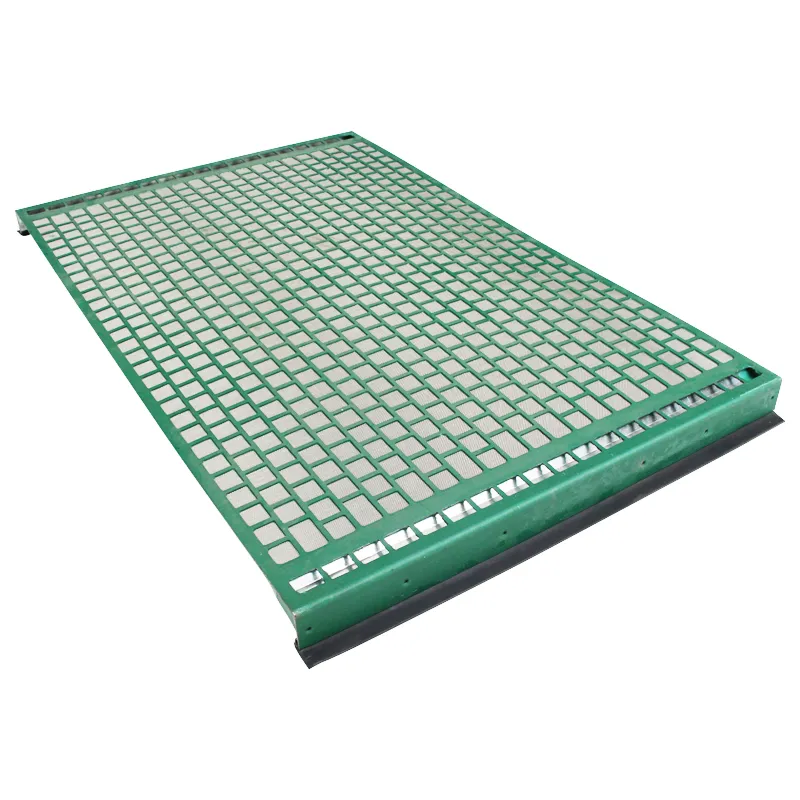

The Power of Pyramid Shaker Screen - A 3-Dimensional SolutionNewsOct.24,2024

-

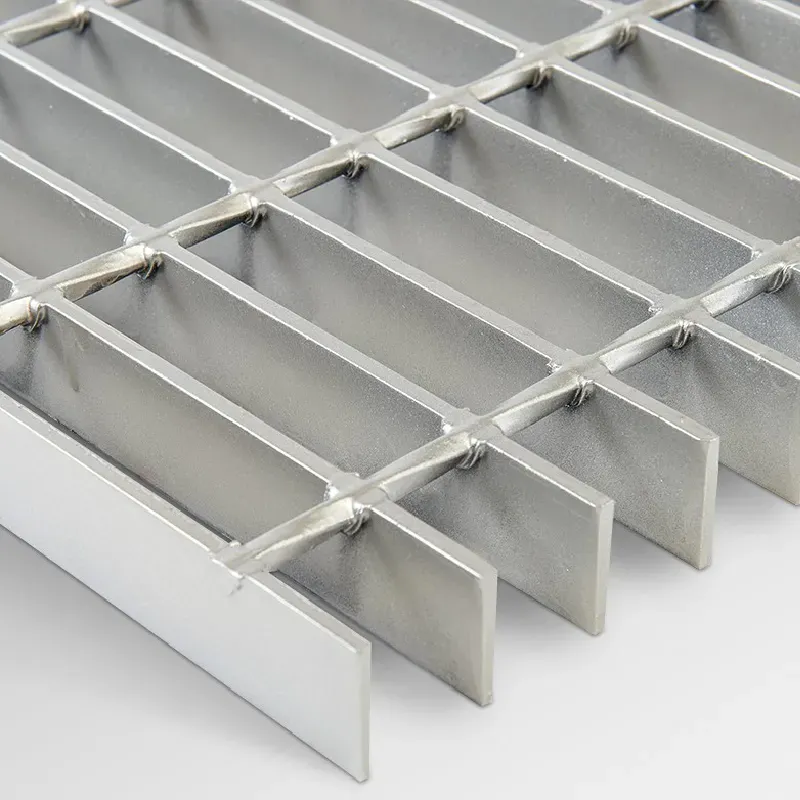

Exploring the Versatility and Durability of Steel GratingNewsOct.24,2024

-

Revolutionizing Drilling Efficiency with Steel Frame Shaker Screens for Mud Shale ShakersNewsOct.24,2024

-

Potential of Shale Shaker ScreensNewsOct.24,2024

-

Offshore Pipeline Counterweight Welded Mesh - Reinforced Mesh in Marine EngineeringNewsOct.24,2024

-

Revolutionizing Offshore Pipeline Stability with Concrete Weight Coating MeshNewsOct.24,2024